40. Peter Klein: 10 Fundamentals Of Economics On Which To Build A Successful Customer-First Business

Our proposition is that the fundamentals of economics – a special humanistic, individualistic, entrepreneurial economics we call Austrian – can be the building blocks of a successful, growing, profitable business that understands and therefore delights its customers. Can you identify these fundamentals?

Key Takeaways And Actionable Insights

Humanism: Business is about serving others, making their lives better. You can engage customers by understanding their hopes and dreams and their highest aspirations. Make humanism the foundation of your business strategy.

Individualism: To understand customers, you must approach them as individuals, not as “targets” or “segments” or “demographics”. Individualism is a methodology: identify one perfect customer and then try to add more that are closely similar.

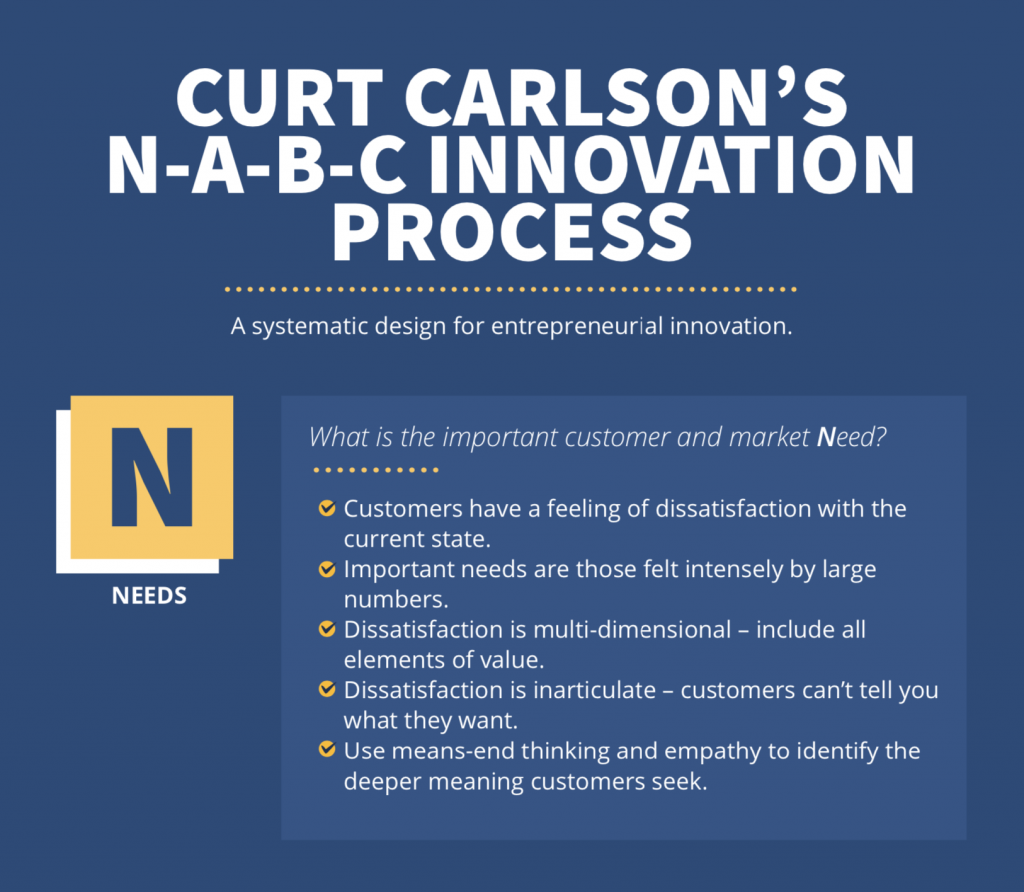

Means and Ends: Customers choose products and services that they believe will serve them as means to achieve their preferred ends or goals. Use means-ends analysis to identify the pathways customers will follow to embrace your offering. Think of it as the customer’s journey through a valued experience that you can make possible for them. (Our free e-book, Understanding The Mind Of The Customer can help.)

Subjective Value: Value is an experience felt by the customer. It’s subjective and idiosyncratic, and can change with time and context and mood. Entrepreneurs must be empathic in diagnosing how customers experience value or its opposite, dissatisfaction, and humble in following changes in value perception that can occur quickly and without warning.

Customer Sovereignty: The customer is your boss, and determines what is valuable, what they will buy and refrain from buying, and which products, services and businesses will be successful. Changes in customer preferences can sometimes seem arbitrary and hard to follow; nevertheless, the entrepreneur’s job is to follow, respond, and ideally, imagine where the customer will go next in their search for betterment.

Uncertainty: The future can not be predicted. Extrapolated trends and predictive models can not deal with the changing preferences of customers over time. Even the customer is not sure what value they will experience when they use your product or service – it emerges from the interaction. Entrepreneurs understand this uncertainty and deal with it, by imagining what the future could be, based on their customer understanding, and adjusting to new information as it becomes available.

Deductive Method: Uncertainty sounds so intimidating. Austrian entrepreneurs use the deductive method to help steer them. Find some principles you know to be true – we know for example, that customers are always seeking betterment – and use those principles to reason your way to understanding complex phenomena. Your specialized knowledge of your chosen business specialty will give you solid grounding. By all means add test data and evaluation data and marketplace results data to your reasoning. But try to find the bedrock principles you can reason from.

The logic of cause and effect: All things are subject to the law of cause and effect. If you can identify the causal linkages, you will be firmly in command of your business. Write the story of the future evolution of your growth path in cause-and-effect language and match it to actual events as they unfold.

The role of time in production: Austrian economics has a unique sensitivity to time in the production process. Entrepreneurs must commit capital now to start production that will be completed in the future, without knowing the future nature of the market – what prices will prevail, what competitive firms will do, how the customer will be feeling about future conditions. Time is a danger to entrepreneurial success – so be as quick as possible, make fast decisions, shorten production cycles, and use time as a scarce resource.

The division of the production chain into higher and lower orders: The value of every link in the production chain reflects the revenue flow from customers to which it contributes. If preferences change, the value of upstream production resources changes. Wherever you operate, B2B or B2C, always keep an eye on end-customer behaviors and preferences. As a B2B supplier, you can be very useful to your business customers by alerting them to end-consumer changes.

DOWNLOADS & EXTRAS

Menger’s Manifesto PDF: Our Free E4E Knowledge Graphic

Understanding The Mind of The Customer: Our Free E-Book