65. David Bienstock on the Business of Politics

When we talk about entrepreneurial alertness to opportunity, it can sound pretty vague. What exactly does that mean? How is alertness translated into profitable action?

Key Takeaways and Actionable Insights

This week’s guest, David Bienstock, provided us with a very precise example. He had just started his media buying services business when a phone call came in. Do you provide service in the category of political advertising? David’s answer was yes. There was no reason for it to be otherwise because there was no information at the time that would indicate any differences between media buying services in the political advertising category compared to the commercial advertising category.

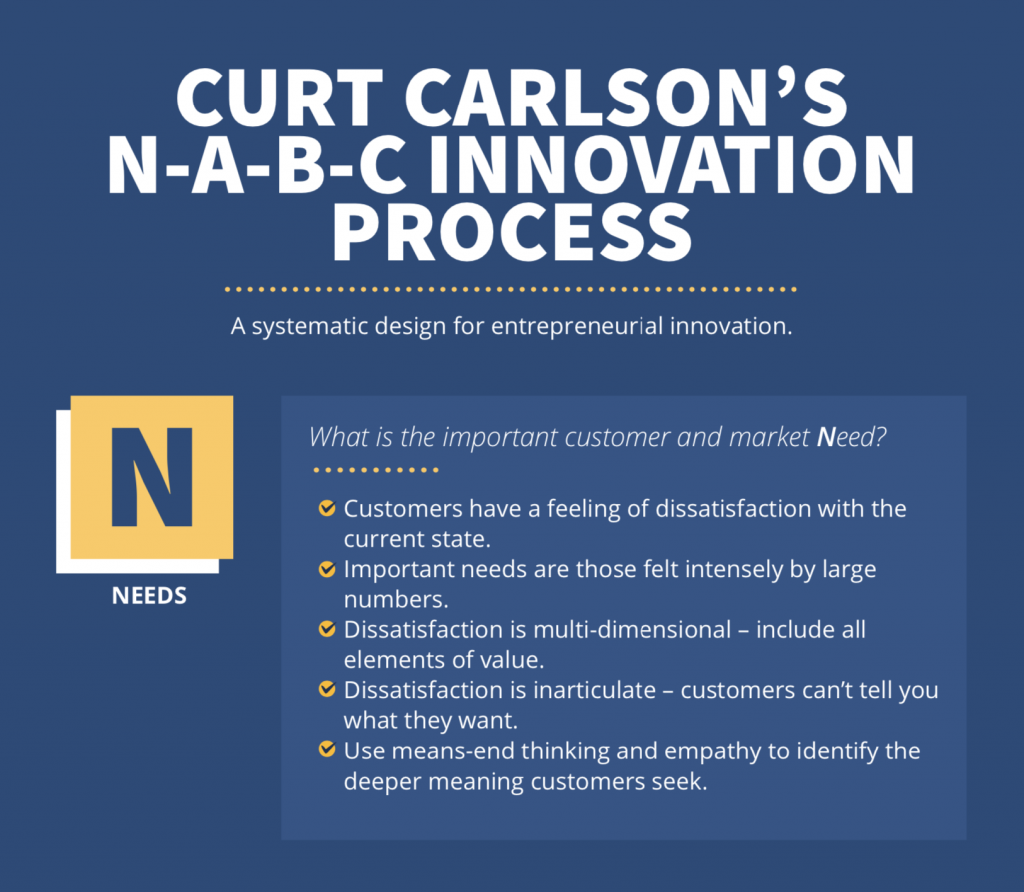

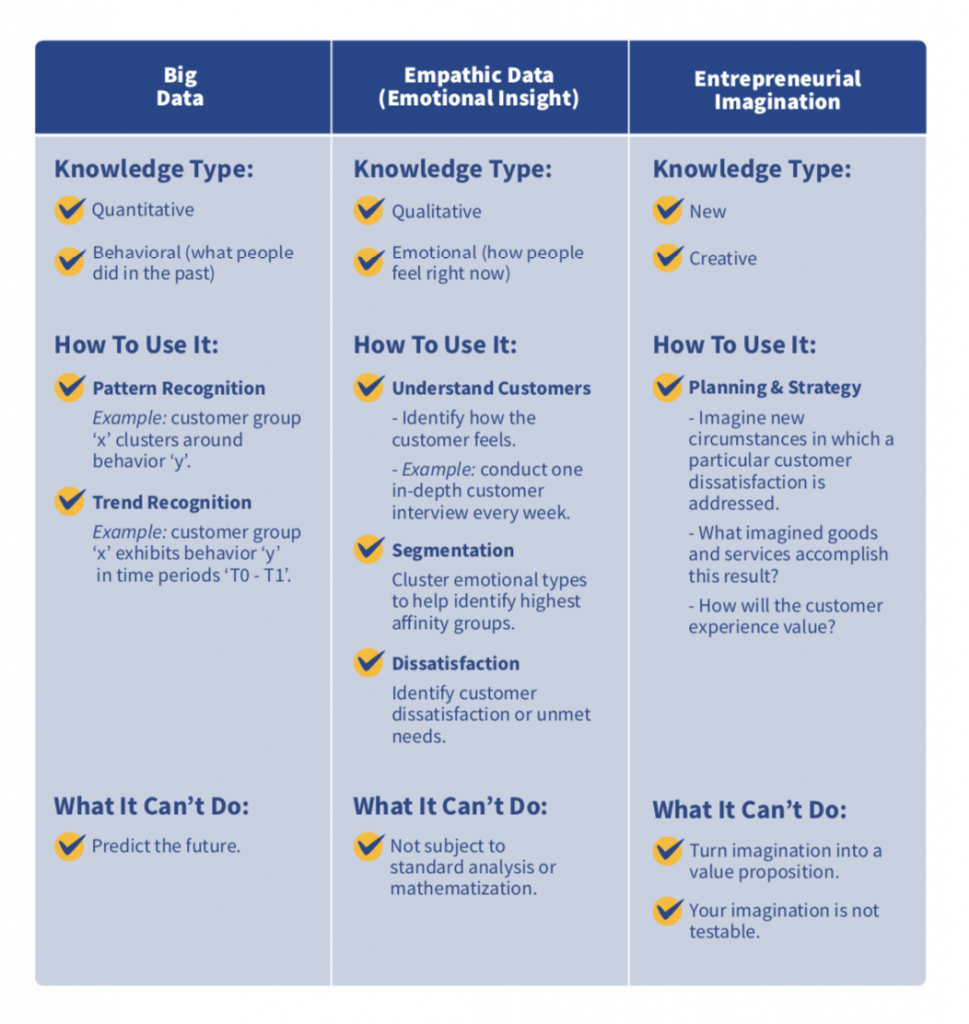

He was able to transfer existing knowledge from his expertise in media buying and placement, and also develop more and more new knowledge. He thereby identified more and more ways in which political advertising was specialized — factors of timing, competitiveness, geography, pricing, regulation, and many more. David built his own island of specialization and became the foremost expert in a burgeoning field.

What can we learn from following David’s entrepreneurial journey?

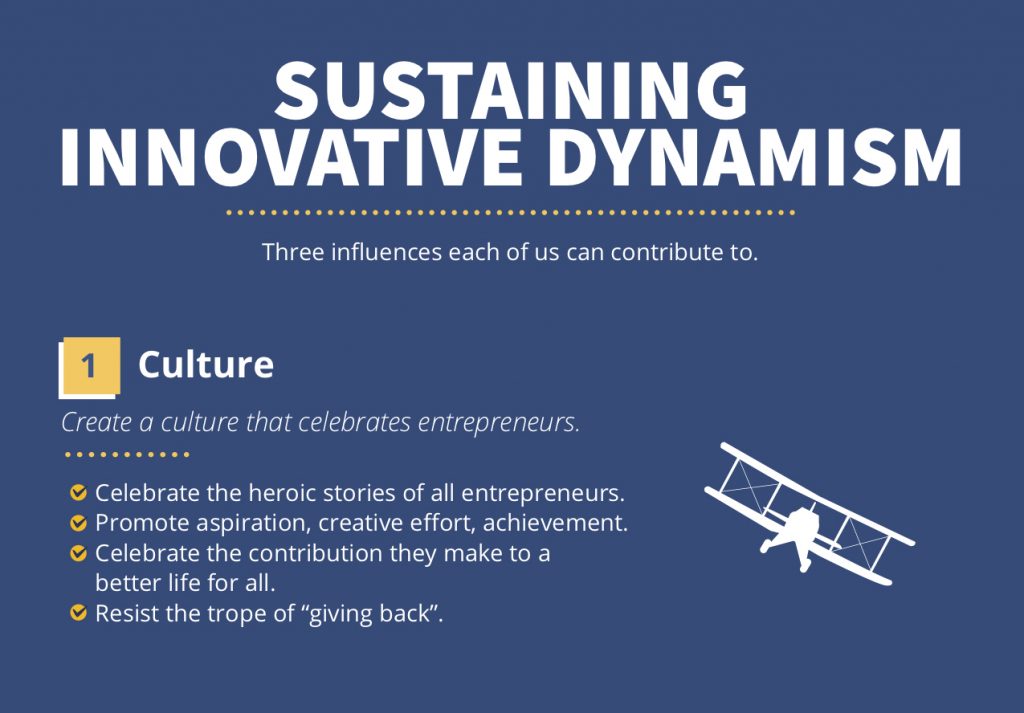

1) The alertness we talk about that entrepreneurs display to opportunities can be triggered by the smallest piece of data. For David, it was one phone call. His instantaneously positive and open response led to a long and successful journey.

2) Wherever there is business expenditure there is an opportunity for an entrepreneurial business service. The business we discussed in episode #65 is campaigning — political, public affairs, ballot measures. How much is spent on campaigns? A lot. There’s the opportunity.

3) The best entrepreneurial businesses are often the ones that clients put you into. David’s inbound phone call was a new client stating an unmet need. That’s all the invitation the alert entrepreneur requires.

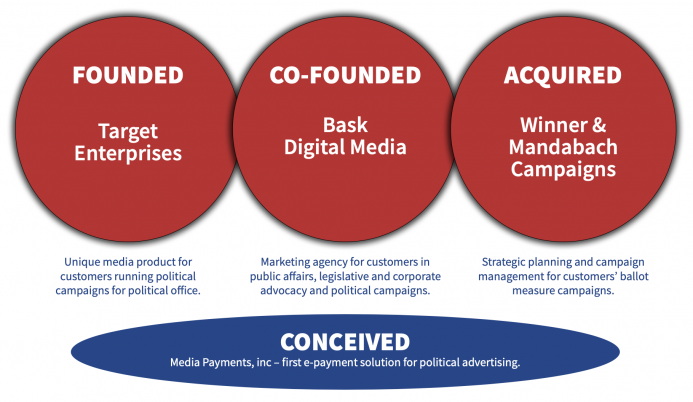

4) Opportunities, once seized, expand. David has expanded his original business by adding many related services for current clients to utilize, including multi-channel media, market research and analytics. In addition, he has added multiple new businesses in related spaces. He’s been creative, he’s taken action, he’s been constantly looking for new opportunities that are complementary to the first one that he spotted. However small the start, the next steps will quickly become apparent to the entrepreneur who is not only alert to opportunity but also to expansion and growth.

Free Downloads & Extras

“David Bienstock’s Logic Of Customer-Led Growth”: Our Free E4E Knowledge Graphic

Understanding The Mind of The Customer: Our Free E-Book

Start Your Own Entrepreneurial Journey

Ready to put Austrian Economics knowledge from the podcast to work for your business? Start your own entrepreneurial journey.